Terms and Conditions

1. Introductory provisions

Genève Invest S.à.r.l. ("Genève Invest" or "the Company") is a limited liability company incorporated under the laws of Switzerland, with its registered office at 6, Place Ruth-Bösiger, 1201 Genève, and is registered with the Commercial Register Office of the Canton of Geneva under the company identification number CHE-109.544.620. Genève Invest (website: www.geneveinvest.ch) can be contacted by telephone (+41 22 716 43 50), fax (+41 22 716 43 52) and e-mail (info@geneveinvest.ch).

Genève Invest is licensed by FINMA as a portfolio manager according to the Financial Institutions Act as of 17.02.2024. Furthermore, Genève Invest is supervised by the supervisory organisation OSFIN, Florastrasse 44, 8008 Zurich.

These General Terms and Conditions ("GTCs") are to be read together with the asset management agreement between Genève Invest and the client ("Client", and jointly with Genève Invest, the "Parties"), and both combined constitute the Agreement. The GTCs govern the business relationship between the Client and Genève Invest unless specific agreements are made.

2. Identification of customers and customer information

When opening a business relationship with Genève Invest, the Client undertakes to provide all documents, evidence and information serving to identify him/her, which are deemed necessary by Genève Invest and/or required by law. This includes documents, evidence and information concerning, among else, the Client's legal or tax status (including civil status and matrimonial property regime), his place of residence and, if applicable, the data of the authorised representative.

Genève Invest establishes a client profile on the Client's financial circumstances, investment experience and knowledge, and assesses the investment objectives based on the information provided by the Client. The Client retains sole responsibility for the accuracy of this information.

Genève Invest advises the Client of the fact that the provision of financial services will not commence until all the information and documents required for the purposes of (i) fulfilling Genève Invest's obligations under money laundering law and (ii) determining the Client's investor profile are available.

During the business relationship, the Client is obliged to inform Genève Invest immediately of any changes to the data he has provided. The Client retains sole responsibility for the accuracy of this information.

3. Customer segmentation

In the absence of a specific declaration by the Client, the Client will be classified as a Private Client in terms of the Financial Services Act. The Client is hereby informed that he may declare that he wishes to be considered a Professional Client. Such a declaration requires that the Client (i) has the knowledge necessary to understand the risks of the investments by virtue of personal education and professional experience or equivalent experience in the financial sector and has assets of at least 500,000 Swiss francs or (ii) has assets of at least 2 million Swiss francs. The decision may result in less protection for the Client.

The Client has been informed, understands, and agrees that he is a qualified investor in terms of the Collective Investment Schemes Act. The consequences of this classification are set out in clause 4. The Client understands and agrees that it is not possible to change to a non-qualified investor under this asset management agreement.

4. Information on the nature and risks of financial instruments

4.1 Market supply considered

The market offerings considered in the selection of financial instruments include Genève Invest's own as well as third-party financial instruments. The following financial instruments are available to the Client within the scope of asset management:

- Shares

- Debt securities

- Units in collective investment schemes (affiliated companies of Genève Invest only)

- Certificates (third-party only)

- Foreign exchange

4.2 Risks

The financial services offered by Genève Invest relate to financial instruments which, due to their respective characteristics or the operations to be carried out, involve certain risks or are subject to price fluctuations on the financial market over which the Company has no control. Returns achieved in the past cannot be considered as indicators of future returns.

The Client confirms that Genève Invest has informed him about the nature, characteristics and risks associated with financial instruments. Prior to the conclusion of the asset management contract, the Client receives Annex 4 - Risks associated with trading in financial instruments of the Swiss Bankers Association (also available at https://www.swissbanking.ch/en/downloads.) The Client is aware of the risks associated with financial products, such as asset preservation risks, economic risks, inflation risks, currency risks, liquidity risks, or market risks. The Client also understands that these risks are within the Client's sphere and that the Client bears them accordingly. The client acknowledges and agrees that, in exceptional cases (particularly for portfolios below CHF 200,000), concentrations of over 10% but below 40% in individual securities, or concentrations of more than 20% but below 40% in individual issuers, cannot be ruled out. This risk disclosure does not apply to concentrations resulting from collective investment schemes, which are subject to regulatory risk diversification requirements and thus achieve diversification at the product level.

The Client acknowledges that he may contact Genève Invest at any time to enquire about specific products and the associated risks. In this context, the Client will receive, upon request, information on the services offered by Genève Invest, the agreed investment strategies and the selected financial instruments, the execution systems, and the associated costs.

As a qualified investor in terms of the Collective Investment Schemes Act, the Client is aware that he has access to forms of collective investment schemes that are open exclusively to qualified investors. This status enables a broader range of financial instruments to be considered in the design of the portfolio. Such financial instruments are thus not or only partially subject to Swiss regulations. Collective investment schemes for qualified investors may be exempt from regulatory requirements. This may give rise to risks pertaining to liquidity, investment strategy, or transparency. Detailed information on the risk profile of a particular collective investment scheme can be found in the constituent documents of the financial instrument and, where applicable, in the basic information sheet and the prospectus.

Furthermore, asset management gives rise to risks that lie within the sphere of risk of Genève Invest and for which Genève Invest is liable vis-à-vis the Client. We have taken appropriate measures to counter these risks by observing the principles of good faith and equal treatment when processing client orders. Furthermore, Genève Invest ensures the best possible execution of client orders.

5. Communication

Communication between the Parties shall be in writing or any other form verifiable by text (including e-mail). Individual orders or specific instructions concerning, for example, transfers or the like must be made by e-mail or in writing.

E-mails are not secured against access by unauthorised third parties and therefore involve corresponding risks such as lack of confidentiality, manipulation of content or sender data, misdirection, delay, or viruses. Genève Invest shall not be liable for any loss or damage resulting from the use of postal and/or delivery services, telephone, fax, e-mail, telegram, or any other form of transmission. Except in the case of gross negligence on the part of Genève Invest, the Client shall bear all losses and damages resulting from misdirected, delayed or lost mail, misunderstandings, forgeries, duplicate mail, or misuse by third parties.

The Client is obliged to keep Genève Invest up to date with his details reported to Genève Invest, e.g., name, address, place of residence, e-mail address, telephone number, etc. Notices from Genève Invest are deemed to have been delivered to the Client when they have been sent to the last delivery address or email address provided by the Client.

6. Execution principles

The execution principles serve to ensure that financial products are always acquired or sold at the best acquisition and sales price for the customer.

Genève Invest does not execute the securities orders within the scope of asset management by itself but uses its partner banks for execution, which fulfil them in accordance with their execution policies. The execution policies of the partner banks were handed over to the Client, and the Client has been informed about the advantages and disadvantages of these policies. When selecting its partner banks, Genève Invest shall verify that the execution policies of the mandated bank will ensure the best possible execution of the securities orders and will take sufficient account of the Client's interests. Notwithstanding the above, the Client acknowledges and accepts that Genève Invest shall not be liable for the execution or non-execution of an order by the partner bank, which is a third party and independent of Genève Invest.

Genève Invest is authorised, in the interest of the Client, to bundle buy and sell orders, subscription right exercises, conversion acts as well as other acts related to asset management with respect to the assets of several clients.

In rare individual cases, such bundling may be disadvantageous for the Client, since the allocation to the individual managed securities accounts, insofar as execution has taken place at more than one price, is based on a mixed price formed according to arithmetic means and may sometimes be subject to delayed execution.

7. Compliance with laws

The Client acknowledges that Genève Invest does not provide advice on legal and fiscal implications under this contract. It is the Client's responsibility to inform himself of the legal obligations and the legal and fiscal consequences relating to the assets under management. The Client is responsible for complying with the Swiss and foreign legal provisions (including tax laws) applicable to him and shall comply with such requirements at all times. It is the Client's responsibility to take appropriate advice where required and to pay his taxes.

The Client acknowledges having knowledge of the fact that trading in certain financial instruments, notwithstanding Genève Invest's competence to make decisions on the financial instruments held in the portfolio, may trigger reporting obligations on the part of the Client, in particular under the Federal Act on Financial Market Infrastructures and Market Conduct in Securities and Derivatives Trading and, where applicable, similar regulations of foreign jurisdictions, and that the Client is solely responsible for compliance with such rules and regulations. The Client acknowledges that Genève Invest is not obliged to inform the Client, generally or in individual cases, of such limits, rules, and regulations.

8. Conflicts of interest

Genève Invest endeavours to prevent any conflicts of interest between the Client on the one hand and Genève Invest and/or its owners, beneficial owners, management, the Chief Compliance Officer, the Chief Risk Officer, agents and all other employees on the other hand. Genève Invest has issued internal directives and taken organisational precautions to identify conflicts of interest and prevent them from adversely affecting the Client.

Within the framework of the asset management contract and in accordance with the investment strategy defined in Appendix 3, Genève Invest may invest part or all of the Client's portfolio in funds managed by affiliated companies. The decision to invest in a fund from affiliated companies is made on the basis of an investment process that makes the fund selection transparent and comprehensible. For funds of affiliated companies, the affiliated companies of Genève Invest will receive as a portfolio manager, co-portfolio manager, as an advisor or as another function of these funds management fees and possibly other fees such as distribution commissions and profit commissions. The remuneration received by the affiliated companies for the services provided to the funds will accrue to the affiliated companies and will be in addition to the contractual remuneration for the benefit of Genève Invest. The Client has no claim against Genève Invest or the affiliated companies regarding the receipt of this remuneration.

The fee models of the various fund classes of the companies affiliated with Genève Invest are listed here. For further information, please refer to the prospectus of the respective fund.

9. Confidentiality and data protection

Genève Invest pledges to maintain professional secrecy in accordance with Art. 69 of the Financial Institutions Act ("FINIG") within the framework of the business relationship with the Client and to treat the Client-specific data, information and documents received as confidential. This obligation shall survive the termination of this contract. The processing of the Client's personal data is carried out in accordance with the privacy policy published on the following website: https://geneveinvest.ch/regulierung/privacy-policy. Genève Invest undertakes to take appropriate technical and organisational precautions to protect the personal data entrusted to it.

The Client hereby releases Genève Invest from all legal or contractual confidentiality obligations and waives any protection pursuant to Art. 69 FINIG and data protection laws:

a) To the extent necessary to enable the provision of services to the Client or the execution of transactions, to ensure compliance with laws, regulations, contractual provisions, business or commercial practices and compliance standards, or to carry out verifications that may be deemed necessary in this context. This includes disclosure to brokers, correspondents, payment system operators, trade repositories, corporate service providers, system operators, central securities depositories, counterparties, or, where applicable, execution venues, clearinghouses, issuers or their agents and their oversight bodies/agencies.

b) To the extent necessary to protect the legitimate interests of Genève Invest, namely:

- in the event of legal action threatened or initiated against Genève Invest (also as a third party), criminal charges or other notifications to authorities;

- to assert its own interests, to secure or enforce the claims of Genève Invest, as well as those of justified third parties against the Client or third parties;

- in the collection of Genève Invest's claims against the Client;

- in the event of accusations made by the Client against Genève Invest in public, in the media or to authorities in Switzerland or abroad.

c) Insofar as Genève Invest uses the services of third parties in Switzerland and abroad to provide the services rendered under this asset management agreement (cf. clause 13). The Client is aware that auxiliary persons or third parties are not necessarily subject to professional secrecy of a similar scope to that pursuant to Art. 69 FINIG

d) Insofar as Genève Invest discloses information relating to the business relationship with the Client to third parties, including the appropriate authorities in Switzerland and, in compliance with Swiss law, authorities abroad, if there is a legal or regulatory obligation to do so. The Client accepts that data transmitted abroad is no longer protected by Swiss law but is subject to the respective foreign data protection and confidentiality laws and may therefore be disclosed in accordance with the applicable foreign laws.

10. Documentation und accountability

On request, Genève Invest shall provide the Client electronically/by e-mail with a copy of the documentation pursuant to Art. 15 of the Financial Services Act and shall, upon request, render an account electronically/by e-mail of the financial services agreed and provided, the composition, valuation and development of the portfolio and the costs associated with the financial services, based on the bank documents prepared by the custodian bank. The Client is advised that the compensation in favour of Genève Invest may not appear in the bank documents.

11. Preservation and evidential value

Genève Invest shall retain all correspondence, communications, contracts, transactions and other documents and information for the period of ten years after the termination of the business relationship with the Client as provided by law.

In exceptional cases, Genève Invest may store the above data for a period of ten years in compliance with the applicable legal provisions (e.g., in the event of suspension of the legal retention period).

Genève Invest's books and documents shall be deemed conclusive until proven otherwise.

12. Outsourcing

Genève Invest may engage third parties in Switzerland and abroad to provide the services rendered under this asset management agreement, particularly in compliance, risk management, IT and data processing systems, and the safekeeping of business records.

Genève Invest shall ensure that the third parties called in have the necessary skills, knowledge, and experience for their activities, as well as the necessary licences and registry entries. Genève Invest is only liable for due diligence in the selection, instruction, and supervision of these third parties.

13. Liability

Genève Invest is responsible for the diligent execution of asset management. While Genève Invest will seek to achieve the Client's objectives as set out in the investment strategy, it is not responsible for the success of the management of the Client's portfolio or any disadvantages, costs, expenses, or losses incurred by the Client in this context. Genève Invest is not liable for general market risks and fluctuations in the value of the assets under management, e.g., due to exchange rate and currency fluctuations. Genève Invest is not authorised to give any assurances or guarantees regarding the performance of the investment instruments. Genève Invest is also not liable for incorrect or incomplete information in prospectuses, basic information sheets or other documents prepared by third parties or for any damages resulting therefrom. Subject to mandatory law, Genève Invest shall be liable to the Client only for direct losses caused by gross negligence or willful misconduct.

14. Indemnification

The Client undertakes to release, indemnify and hold harmless Genève Invest from any liability, claims, costs, damages, demands, losses, expenses, disadvantages and all claims for damages, including those of a future nature which Genève Invest may incur directly or indirectly in connection with any act or omission, the execution and/or non-execution of an instruction by the Client, even if the Client is not at fault unless Genève Invest has acted intentionally or with gross negligence.

15. Exercise of rights associated with the financial instruments

Genève Invest may, but is not obliged, with subject to mandatory law, to exercise voting rights or other non-monetary membership rights in respect of the financial instruments in the managed portfolio, based on and in accordance with the express instructions of the Client.

16. Complaint management

The Client has the option of submitting any complaints to the Compliance Department of Genève Invest by post or by e-mail:

Genève Invest S.à.r.l.

6, place Ruth-Bösiger

1201 Genève

For efficient processing of the complaint, at least a summary of the content of the complaint and the name and contact details of the complainant are required.

Genève Invest will send an acknowledgement of receipt to the complainant within ten working days of receipt of the complaint unless the reply letter has already been sent within this period. The complaint will be forwarded immediately to the relevant department, and a reply will be sent within twenty working days of receipt of the complaint. This reply will include the name and contact details of the responsible employee.

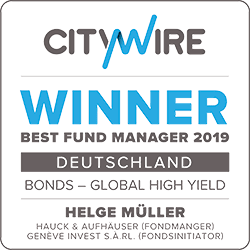

If the Client feels that he has not received a satisfactory response to his complaint, he may forward his complaint to the person responsible for client complaints on the Board of Directors of Genève Invest, Mr Helge Müller. Mr Helge Müller can be contacted in this regard at the following e-mail address: helge.mueller@geneveinvest.ch.

After going through Genève Invest's internal complaints procedure, the Client may initiate a mediation procedure through the Ombudsman's Office at the following address:

Ombud Finanzen Schweiz

10 rue du Conseil-Général

1205 Genf

Tel. +41 22 808 04 51

E-Mail: contact@ombudfinance.ch

Website: https://ombudfinance.ch

17. Changes

Genève Invest has the right to amend its GTCs at any time. Genève Invest is responsible for announcing the changes in advance and in an appropriate manner. Unless the client objects in writing within one month of notification, the amendments shall be deemed to have been approved. In the event of objection, the Client is free to terminate the business relationship with immediate effect.

18. Applicable law and place of jurisdiction

All legal relations between the Client and Genève Invest, including the question of their validity and legal effectiveness, shall be governed exclusively by Swiss substantive law, to the exclusion of the provisions of international private law and other conflict-of-law rules. The place of performance, the place of debt collection for clients with a foreign domicile / registered office and the exclusive place of jurisdiction for all proceedings is Geneva. However, the asset manager has the right to take legal action against the Client before the competent court of his domicile / registered office or any other competent court. Mandatory legal provisions remain reserved.